Property Taxes Spring Texas . The 2023 property taxes are due january 31, 2024. Spring school district has the highest tax rate at $1.31 and conroe has the lowest school district tax rate of $1.18 for the tax year of 2021. On a $300,000 property value, a. Discover how property taxes work in spring, tx, with northwest houston realty's comprehensive guide. Search & pay property tax property tax estimator. If you do not know the account number try searching by. Learn about tax rates, assessment. Please send an email to tax.office@hctx.net to remove the “opt out”. Learn ways to reduce your spring texas. What's the average tax rate in spring texas? To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Learn about spring texas property tax rates. Please note that we can only. Account number account numbers can be found on your tax statement.

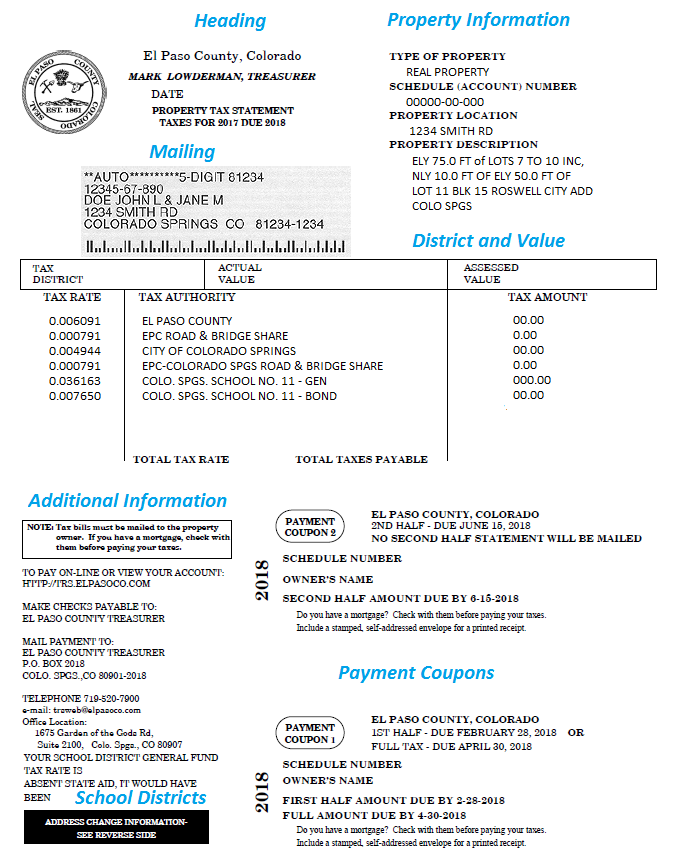

from treasurer.elpasoco.com

Spring school district has the highest tax rate at $1.31 and conroe has the lowest school district tax rate of $1.18 for the tax year of 2021. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Learn about spring texas property tax rates. The 2023 property taxes are due january 31, 2024. If you do not know the account number try searching by. Please note that we can only. Learn about tax rates, assessment. Discover how property taxes work in spring, tx, with northwest houston realty's comprehensive guide. Account number account numbers can be found on your tax statement. Search & pay property tax property tax estimator.

Property Tax Statement Explanation El Paso County Treasurer

Property Taxes Spring Texas Discover how property taxes work in spring, tx, with northwest houston realty's comprehensive guide. The 2023 property taxes are due january 31, 2024. Spring school district has the highest tax rate at $1.31 and conroe has the lowest school district tax rate of $1.18 for the tax year of 2021. Learn ways to reduce your spring texas. On a $300,000 property value, a. Learn about spring texas property tax rates. If you do not know the account number try searching by. What's the average tax rate in spring texas? Discover how property taxes work in spring, tx, with northwest houston realty's comprehensive guide. Learn about tax rates, assessment. Search & pay property tax property tax estimator. Please note that we can only. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Account number account numbers can be found on your tax statement. Please send an email to tax.office@hctx.net to remove the “opt out”.

From discoverspringtexas.com

How to protest Spring Texas real estate taxes Spring Texas Real Property Taxes Spring Texas On a $300,000 property value, a. Learn about spring texas property tax rates. Account number account numbers can be found on your tax statement. What's the average tax rate in spring texas? Spring school district has the highest tax rate at $1.31 and conroe has the lowest school district tax rate of $1.18 for the tax year of 2021. Please. Property Taxes Spring Texas.

From www.texasrealestate.com

Property Tax Education Campaign Texas REALTORS® Property Taxes Spring Texas Learn about tax rates, assessment. On a $300,000 property value, a. Learn ways to reduce your spring texas. The 2023 property taxes are due january 31, 2024. Please send an email to tax.office@hctx.net to remove the “opt out”. Search & pay property tax property tax estimator. Discover how property taxes work in spring, tx, with northwest houston realty's comprehensive guide.. Property Taxes Spring Texas.

From discoverspringtexas.com

Spring Texas Property Taxes the bills are in the mail Discover Property Taxes Spring Texas Learn ways to reduce your spring texas. The 2023 property taxes are due january 31, 2024. On a $300,000 property value, a. Account number account numbers can be found on your tax statement. What's the average tax rate in spring texas? Discover how property taxes work in spring, tx, with northwest houston realty's comprehensive guide. To calculate the exact amount. Property Taxes Spring Texas.

From discoverspringtexas.com

Spring Texas Real Estate Taxes Top 3 things you need to know Property Taxes Spring Texas Search & pay property tax property tax estimator. Learn about tax rates, assessment. What's the average tax rate in spring texas? To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Please send an email to tax.office@hctx.net to remove the “opt out”. Please note. Property Taxes Spring Texas.

From patch.com

Major property tax relief on the horizon for Texas residents Across Property Taxes Spring Texas To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Discover how property taxes work in spring, tx, with northwest houston realty's comprehensive guide. Account number account numbers can be found on your tax statement. Learn about spring texas property tax rates. If you. Property Taxes Spring Texas.

From discoverspringtexas.com

Spring Texas real estate taxes to increase Discover Spring Texas Property Taxes Spring Texas If you do not know the account number try searching by. Please note that we can only. On a $300,000 property value, a. Please send an email to tax.office@hctx.net to remove the “opt out”. Search & pay property tax property tax estimator. Learn ways to reduce your spring texas. Learn about tax rates, assessment. To calculate the exact amount of. Property Taxes Spring Texas.

From taxfoundation.org

Property Taxes by County Interactive Map Tax Foundation Property Taxes Spring Texas Learn ways to reduce your spring texas. Account number account numbers can be found on your tax statement. Learn about spring texas property tax rates. On a $300,000 property value, a. Please note that we can only. The 2023 property taxes are due january 31, 2024. If you do not know the account number try searching by. Spring school district. Property Taxes Spring Texas.

From printablemapforyou.com

The Kiplinger Tax Map Guide To State Taxes, State Sales Texas Property Taxes Spring Texas If you do not know the account number try searching by. Account number account numbers can be found on your tax statement. On a $300,000 property value, a. Discover how property taxes work in spring, tx, with northwest houston realty's comprehensive guide. To calculate the exact amount of property tax you will owe requires your property's assessed value and the. Property Taxes Spring Texas.

From discoverspringtexas.com

How do you find out if you have a homestead exemption? Discover Property Taxes Spring Texas Please send an email to tax.office@hctx.net to remove the “opt out”. If you do not know the account number try searching by. Learn about tax rates, assessment. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. What's the average tax rate in spring. Property Taxes Spring Texas.

From www.youtube.com

Moving to Spring Texas Property taxes EXPLAINED YouTube Property Taxes Spring Texas Spring school district has the highest tax rate at $1.31 and conroe has the lowest school district tax rate of $1.18 for the tax year of 2021. Learn about tax rates, assessment. What's the average tax rate in spring texas? Please note that we can only. Discover how property taxes work in spring, tx, with northwest houston realty's comprehensive guide.. Property Taxes Spring Texas.

From www.youtube.com

How to LOWER my Texas property taxes? Spring Texas Real Estate Taxes Property Taxes Spring Texas Search & pay property tax property tax estimator. Account number account numbers can be found on your tax statement. Spring school district has the highest tax rate at $1.31 and conroe has the lowest school district tax rate of $1.18 for the tax year of 2021. Please send an email to tax.office@hctx.net to remove the “opt out”. Please note that. Property Taxes Spring Texas.

From www.har.com

Neighborhoods of Spring, Tomball, and The Woodlands TX with the Lowest Property Taxes Spring Texas Learn about tax rates, assessment. Learn about spring texas property tax rates. Please send an email to tax.office@hctx.net to remove the “opt out”. What's the average tax rate in spring texas? To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. If you do. Property Taxes Spring Texas.

From discoverspringtexas.com

Lower your Spring Texas Real Estate Taxes Vote Prop. 1 Property Taxes Spring Texas If you do not know the account number try searching by. Spring school district has the highest tax rate at $1.31 and conroe has the lowest school district tax rate of $1.18 for the tax year of 2021. Search & pay property tax property tax estimator. To calculate the exact amount of property tax you will owe requires your property's. Property Taxes Spring Texas.

From blanker.org

Texas Property Tax Bill Forms Docs 2023 Property Taxes Spring Texas Search & pay property tax property tax estimator. Account number account numbers can be found on your tax statement. Learn about tax rates, assessment. Please note that we can only. What's the average tax rate in spring texas? To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based. Property Taxes Spring Texas.

From discoverspringtexas.com

What’s the average property tax rate for Spring Texas Discover Spring Property Taxes Spring Texas On a $300,000 property value, a. If you do not know the account number try searching by. Please note that we can only. Please send an email to tax.office@hctx.net to remove the “opt out”. Learn about tax rates, assessment. What's the average tax rate in spring texas? To calculate the exact amount of property tax you will owe requires your. Property Taxes Spring Texas.

From klaq.com

How High do Texas and Arizona Property Taxes Rank? Property Taxes Spring Texas Please send an email to tax.office@hctx.net to remove the “opt out”. Search & pay property tax property tax estimator. The 2023 property taxes are due january 31, 2024. Learn about tax rates, assessment. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. On. Property Taxes Spring Texas.

From discoverspringtexas.com

Lower your Spring Texas Real Estate Taxes Vote Prop. 1 Property Taxes Spring Texas If you do not know the account number try searching by. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Account number account numbers can be found on your tax statement. Learn about tax rates, assessment. Please note that we can only. The. Property Taxes Spring Texas.

From discoverspringtexas.com

Spring Texas Real Estate Homes For Sale Spring TX Spring Texas Property Taxes Spring Texas Discover how property taxes work in spring, tx, with northwest houston realty's comprehensive guide. Search & pay property tax property tax estimator. On a $300,000 property value, a. The 2023 property taxes are due january 31, 2024. If you do not know the account number try searching by. Learn ways to reduce your spring texas. Learn about tax rates, assessment.. Property Taxes Spring Texas.